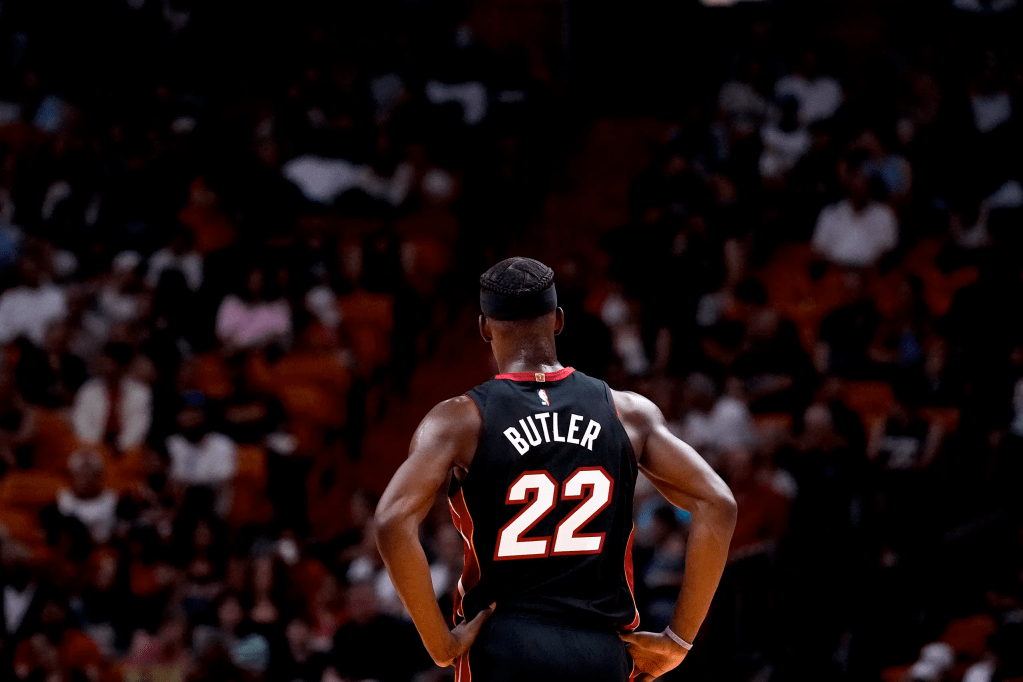

This mid-season blockbuster saw perennial playoff contender Jimmy Butler move from the Miami Heat to the Golden State Warriors in a five-team trade that reshaped multiple rosters and had significant repercussions across the league’s salary cap landscape.

But this deal was not merely about swapping talent, it was about championship timing, cap flexibility, and structural positioning under the NBA’s current Collective Bargaining Agreement.

Before diving into the cap mechanics, here’s how the trade broke down.

What Each Team Received

Warriors receive:

- Jimmy Butler (from Miami)

- Two second-round picks (from Miami)

- Cash considerations (from Miami)

As part of the trade, Butler declined his 2025–26 player option and signed a two-year, ~$121M extension with Golden State, aligning his contract with Steph Curry and Draymond Green through 2026–27.

Heat receive:

- Andrew Wiggins (from Golden State)

- Kyle Anderson (from Golden State)

- Davion Mitchell (from Toronto/Raptors routing)

- 2025 first-round pick (protected) from Golden State

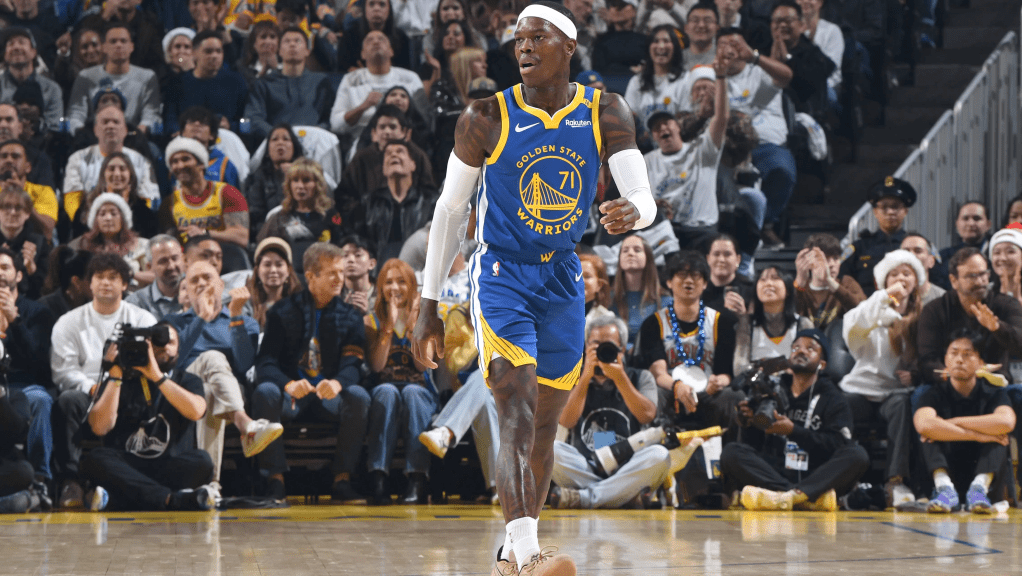

Detroit Pistons receive:

- Dennis Schröder (from Utah via Golden State)

- Lindy Waters III (from Golden State)

- 2031 second-round pick (from Golden State)

Utah Jazz receive:

- KJ Martin (from Detroit via Sixers)

- Josh Richardson (from Miami)

- 2028 second-round pick (from Detroit via Sixers)

- 2031 second-round pick (from Miami)

- Cash considerations (from Miami)

Toronto Raptors receive:

- P.J. Tucker

- 2026 second-round pick (via Miami)

- Cash considerations (via Miami)

Why the Warriors Made This Move

Championship Window Context

Golden State came into the 2024-25 season with Steph Curry and Draymond Green still elite, but an inconsistent supporting cast left them squarely in the playoff “bubble.” Rather than accept a middling outcome, the front office saw an opportunity to re-orient their competitive trajectory. Adding Butler — a six-time All-Star and multi-Finals contributor — was designed to:

- Elevate their competitive ceiling immediately

- Provide a true third star alongside Curry and Green

- Add physicality, playoff toughness, and late-game scoring punch

Following the trade, Golden State remained above the luxury tax but below the first apron, with their overall team salary staying relatively flat due to near one-for-one salary matching. The deal did not materially change their immediate apron status, but it did solidify a top-heavy cap structure built around Curry, Green, and Butler. In short, the Warriors were already operating as a tax team, and this move doubled down on that reality without pushing them into new cap territory midseason.

While Golden State has championship pedigree, their offensive and defensive floor wasn’t reliably high enough without an elite two-way scorer/leader like Butler.

Cap Mechanics: Why This Deal Was Possible

1. Salary Matching and Multi-Team Routing

NBA trade rules require that for teams over the salary cap, incoming salary must be matched with outgoing salary within permissible ratios. At the deadline, the Warriors were an over-the-cap team, meaning they couldn’t simply acquire Butler without sending out commensurate salary.

So Golden State sent out:

- Andrew Wiggins

- Dennis Schröder

- Kyle Anderson

- Lindy Waters III

- A protected 2025 first-round pick

This patchwork of salaries met the matching requirements to absorb Butler’s roughly $48–55M cap hit for the 2024–25 season.

2. Extension vs. Player Option

Butler initially held a lucrative player option for 2025–26, but in joining Golden State, he declined that option in favor of a two-year, ~$121M extension (≈ ~$60M per year).

This did two things from a cap perspective:

- It locks his salary onto the Warriors’ cap sheet predictably rather than leaving a big question mark.

- It allows Golden State to plan their next two seasons around Butler, Curry, and Green, creating a clearly defined championship window.

3. Trade Exceptions and Future Maneuverability

By distributing salary across multiple players and keeping draft assets, Golden State retains flexibility to:

- Generate trade exceptions in future deals

- Use whatever mid-level exception capacity remains

- Navigate around a packed long-term payroll as needed

Even with large star salaries, the structure avoids over-committing further than necessary today.

Why Miami Did the Trade

1. Return Assets and Reset

The Heat received a mix of:

- Andrew Wiggins, a versatile wing with defensive utility

- Kyle Anderson, rotation depth

- Davion Mitchell, a tough defensive guard

- A 2025 first-round pick (top-10 protected)

Miami also stayed over the salary cap after the trade and remained a luxury-tax team, but the composition of their payroll shifted meaningfully. By moving off Butler’s max-level salary and replacing it with a combination of mid-sized and expiring contracts, the Heat avoided increasing their tax or apron pressure while improving future flexibility. While their cap position in the short term did not drastically change, the deal reduced long-term risk and gave Miami more control over its payroll structure moving forward.

This package gives Miami more financial flexibility, tradable assets, and a foundational pick to build around, especially after months of on-court and off-court tension with Butler.

2. Clearing Uncertainty

Butler’s final stretch in Miami included disciplinary issues and multiple suspensions, creating instability. Trading him turned that uncertainty into tangible returns rather than ongoing disruption.

Cap Implications for Other Teams

Detroit Pistons: By acquiring Dennis Schröder, Lindy Waters III, and a 2031 second-round pick, Detroit added veteran presence and draft capital while preserving cap flexibility and roster control.

Utah Jazz: Utah’s haul of KJ Martin, Josh Richardson, multiple second-round picks, and cash gives them movable contracts and assets, aligning with a longer-term construction strategy.

Toronto Raptors: Toronto received P.J. Tucker, a 2026 second-round pick, and cash, adding experienced depth without major cap strain.

Championship Impact & What Comes Next

For the Warriors, this trade wasn’t just transactional — it was a strategic upgrade designed to push a championship window anchored by Curry and Green. While the increased payroll complicates future roster moves, the immediate competitive uptick since Butler’s arrival reflects a bet on present success over future flexibility.

By contrast, Miami chose future optionality and roster reshaping over staying the course with Butler’s max-level contract.

Ultimately, this trade highlights how salary cap mechanics and competitive timeline alignment drive the biggest NBA deals — teams only pull the trigger on blockbusters when cap structure permits and timelines require.

Final Takeaway

- Golden State used salary matching and a star extension to build a title contender at the right moment.

- Miami converted instability into assets and a reset opportunity.

- Other teams leveraged the deal to add tradable contracts and draft capital.

In today’s NBA, championship building isn’t just about acquiring talent — it’s about structuring cap around that talent.

Thank you for reading.

— Armaan Sharma

Leave a comment